An accounting degree from Rockhurst University sets students up for a successful accounting career through rigorous coursework and the application of fundamental concepts.

Program Overview

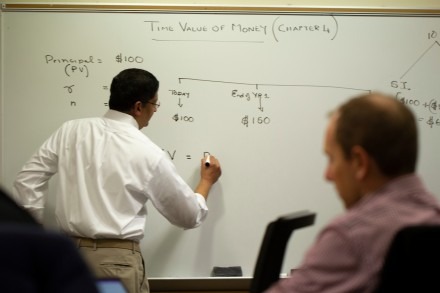

Image

Students pursuing an accounting major within the Bachelor of Science in Business Administration (BSBA) program learn fundamental accounting concepts and use key accounting and statistical software necessary for success in accounting, such as SAGE 50, Quick Books, R, and Microsoft Dynamics GPA. While not a traditional accounting bachelor's degree, a business degree with an accounting concentration from Rockhurst prepares graduates to engage in the discourse and application of information. It also helps prepare students pursuing the Certified Public Accountant (“CPA”) designation through Master’s level accounting certificate courses, which include the Becker review course curriculum.

College of Business & Technology Learning Outcomes

- Leadership: Graduates with an accounting degree from RU exhibit skills in personal responsibility, awareness of self and others, ability to work effectively in groups, and the ability to foster positive team dynamics.

- Ethical Behavior and Corporate Social Responsibility: Graduates identify and analyze personal ethical problems to propose and defend an appropriate course of action; identify and analyze issues in corporate social responsibility to propose and defend an appropriate course of action through an accounting career.

- Business Skills and Knowledge: Graduates define, describe and demonstrate foundational business knowledge.

- International/Global: Graduates learn to integrate relevant cultural, social, political, historical, geographic and environmental factors into the analysis of business issues and the development of an appropriate course of action through the accounting major.

- Information Analysis and Application: Graduates identify, access and analyze relevant quantitative and qualitative information to develop, select and evaluate appropriate courses of action.

- Communication: Graduates produce and deliver effective written products and oral communications in a variety of contexts using effective technologies.

Program Outcomes

As an accounting major, students complete two innovative sequences in the BSBA core curriculum. The Helzberg School of Management developed both the Professional Readiness sequence and the Technology and Predictive Analytics sequences based on market research and consultation with hiring managers at area corporations to prepare students for the evolving workplace. Students also have the option to pursue Excel certifications as part of their studies.

What salary can I expect with an accounting degree?

According to Payscale, most entry-level accountants make around $47,000, but that can grow to over $58,000 later in their career. This can get higher as accountants move around jobs as well, becoming senior accountants, accounting managers, and more.

The Helzberg School of Management is an AACSB*-accredited business school, an achievement only 5% of all business schools in the world can claim. Students in the Helzberg School of Management emerge from their bachelor's education as leaders of competence and conscience.

*Association to Advance Collegiate Schools of Business

What can you do with an accounting degree?

Accountants provide vital financial information used for decision-making. Accounting is known as the “language of business” and as such, touches all business disciplines. Through auditing, accountants perform an objective examination and evaluation of a company’s financial statements, providing relevant and reliable assurance as to the accuracy of the financial results for investors, creditors, and other users of the data.

After graduation, Rockhurst alumni have worked in all types (public, government, not-for-profit) and positions (auditor, staff, financial, credit, or budget analyst as well as loan specialist) of accounting. Some of the firms at which recent graduates begin their accounting careers include:

- RubinBrown

- Pricewaterhouse Coopers

- KPMG

- Forvis

- H&R Block

- Deloitte

- Ernst & Young

- CBIZ MHM

Certified Public Accountant (CPA)

Audit Manager

Tax Accountant

Chief Financial Officer (CFO)

Chief Investment Officer (CIO)

External Auditor

Forensic Accountant

Financial Manager

Course Map

Degree and class descriptions and requirements can be found by clicking on the course catalog listings below:

Popular Courses

Students will obtain an intermediate level of Excel proficiency and pass the Excel Certification exam, use descriptive statistics to better understand business problems, and much more.

Managerial Accounting is the continuation of a student’s journey to understand the role and the language of the accountant. The course begins with some additional financial accounting topics and then moves quickly to a managerial perspective with the focus on provider information for internal decision makers. The student will be introduced to new terminology and concepts while carrying forward what they learned in financial accounting. Some of the topics include ratio analysis, the statement of cash flow, cost accounting concepts and tools, cost volume profit analysis, budgeting and relevant costs.

his course utilizes a series of prescriptive and predictive analytical tools such as forecasting, advanced regression, statistical process control, linear programming, network models and data mining to examine real world business problems. Students will develop skills in defining a business problem, selecting the appropriate tool for solving the problem, and effectively communicating the results.

This course is an integrative capstone experience focusing on strategy and policy development for organizations within the context of sometimes conflicting ethical constraints. Strategy implementation challenges are also explored. The course provides an opportunity to integrate the knowledge drawn from functional area courses in the solution of problems discovered by the analysis of both published cases and live interactions with the managers of companies and organizations within the Kansas City region.

Degree Info

- Internships: The Rockhurst University Center for Career Development helps students search for internships consistent with their interests.

- Hands-on Class Projects: Class projects include an Accounting Information Systems (AIS) project as well as a capstone project.

- Magis Leaders Program: Students pursuing an accounting degree can apply for a year-long, enhanced professional readiness program.

- Extracurricular Experiences: Many students participate in Volunteer Income Tax Assistance (VITA), a program where they prepare tax returns for low-income, high-need families in the community.

- Networking: Students have tons of opportunities to network with prospective employers both through the Helzberg School of Management and Rockhurst University Career Services events such as Leadership & Ethics Day, Dinner with the Industry and RU Career Fair.

- Dean's Scholar Program – earn a bachelor's and master's degree in only five years! Learn more about the program here.

Find Your Program

Choose topic to quickly find specific program details